advantages and disadvantages of llc for rental property

Here are the three potential drawbacks of this solution. Structuring an LLC can come with significant tax advantages and several other benefits which can apply to rental properties.

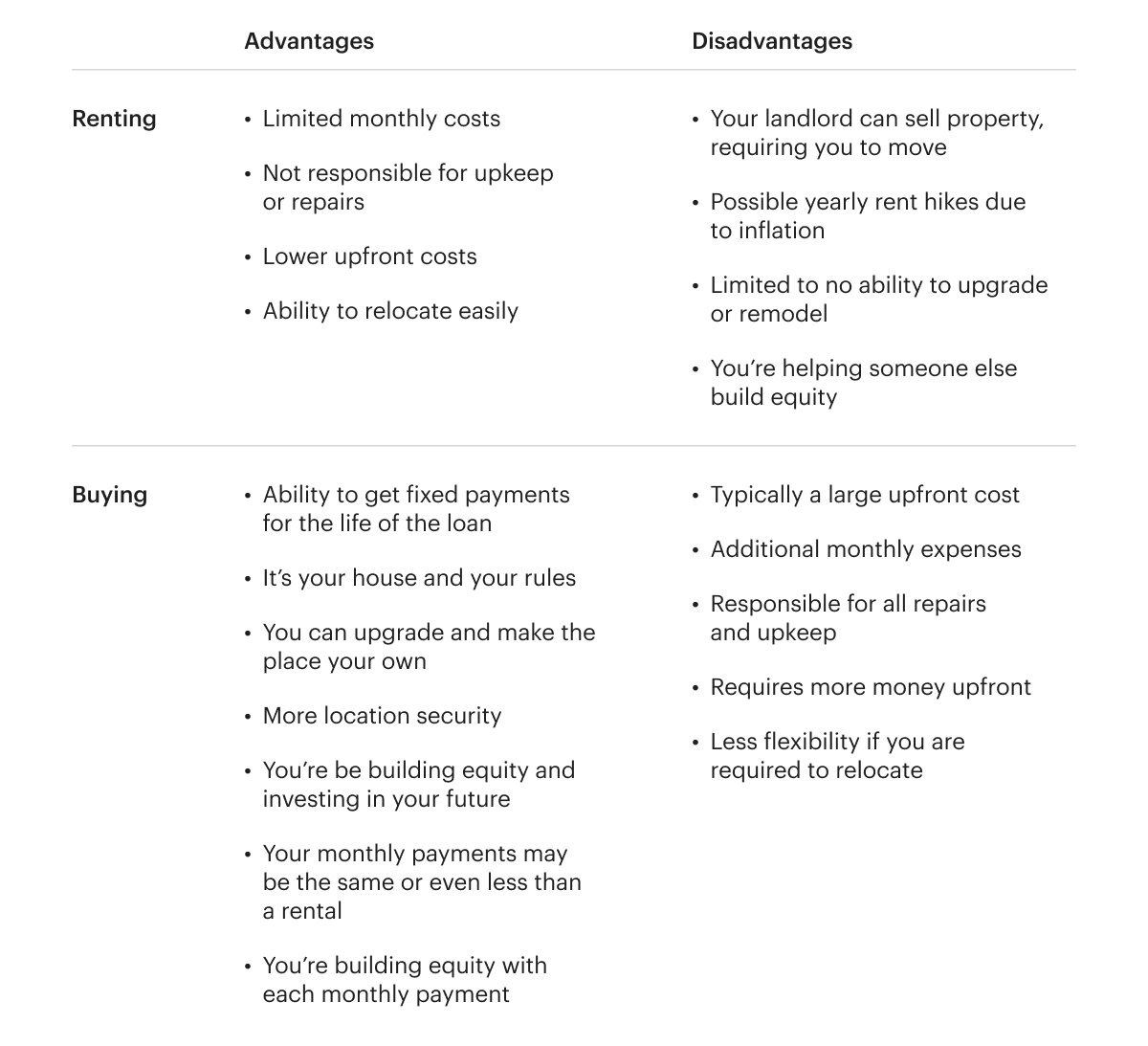

The Advantages And Disadvantages Of Month To Month Leases

A Tangible Personal Property Tax is levied against businesses and rental properties and it is an ad valorem tax levied against furniture fixtures and equipment.

. Tax Disadvantages Advantages of Rental Property. Pros of an LLC for rental property. Payment is not restricted to the owners of the LLC.

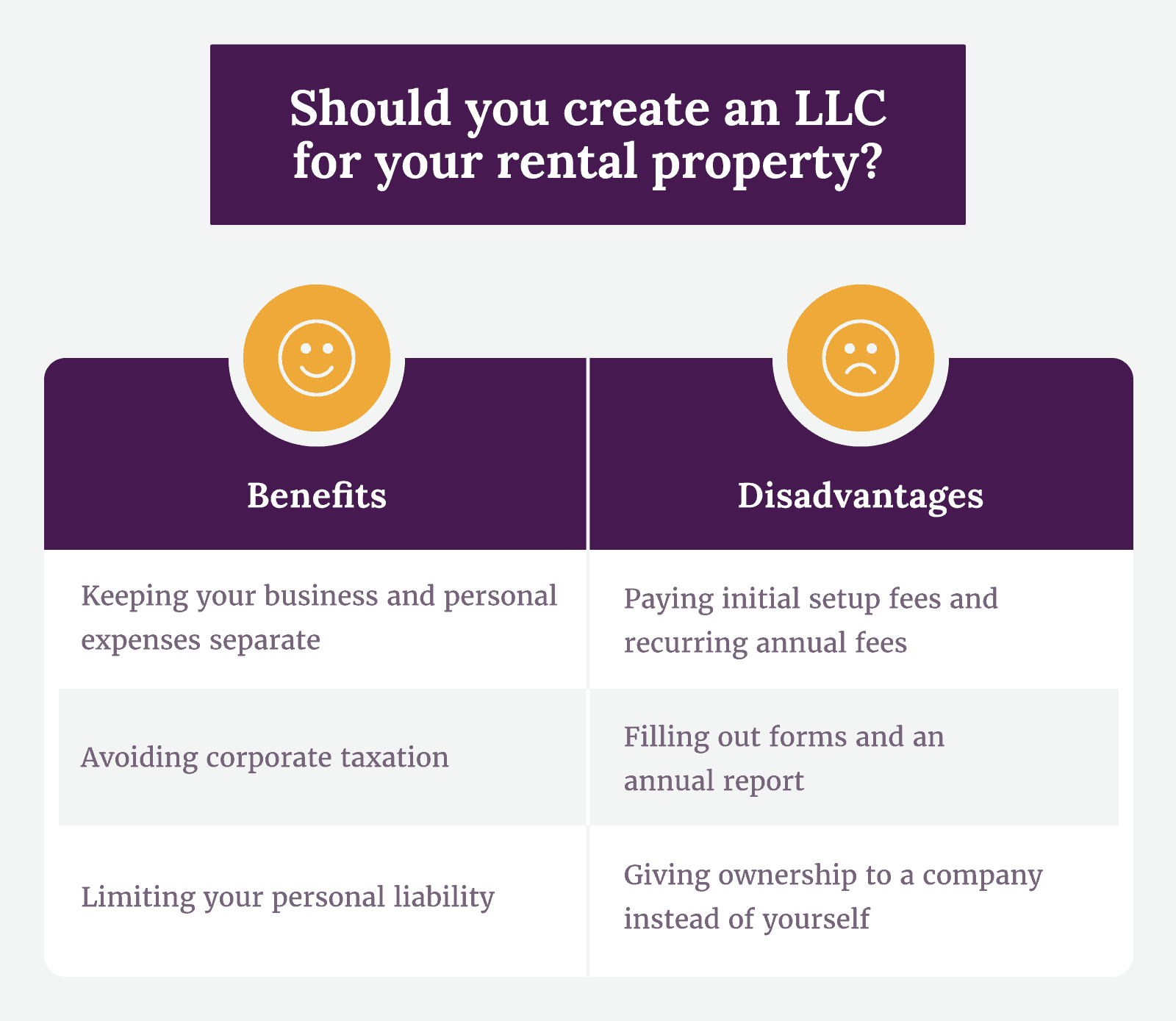

Although owning rental property is an excellent way to invest capital many investors also buy it as a tax shelter. One of the major disadvantages of setting up an LLC for rental property is the upfront costs. A limited liability company is better for asset protection and can separate your rental debts from your liabilities.

A public company as opposed to a limited company issues shares of stock ownership that can be publicly traded on a. When using the LLC structure for a rental property there are zero restrictions in place regarding how the company. Benefits of an LLC for a rental property.

Real estate investors -just like every business owner- need to track their income and expenses so. For tax purposes an LLC allows you to treat a. It Costs Money to Register an LLC for Single Family Rental Properties.

Disadvantages of an LLC For Rental Property Businesses. LLCs have management flexibility that other structures dont provide. The aforementioned benefits come at a cost.

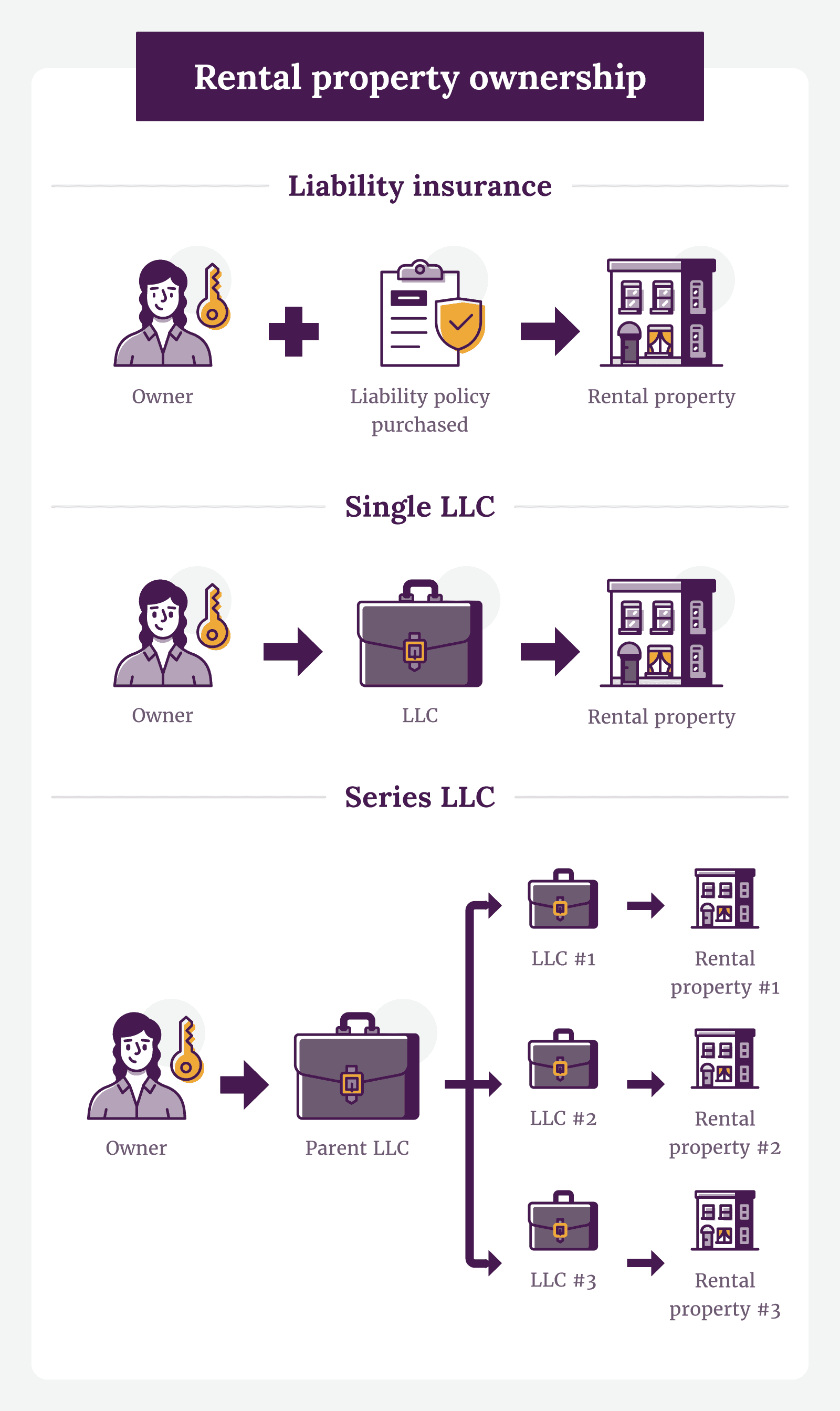

Here are some of the benefits of investing in rental properties. Holding a rental property under an LLC may help to protect the personal assets of an investor in the event of a. List of the Advantages of a Limited Liability Company LLC 1.

Depending on the state. Advantages of Rental Properties. Easy Mobilization of Resources.

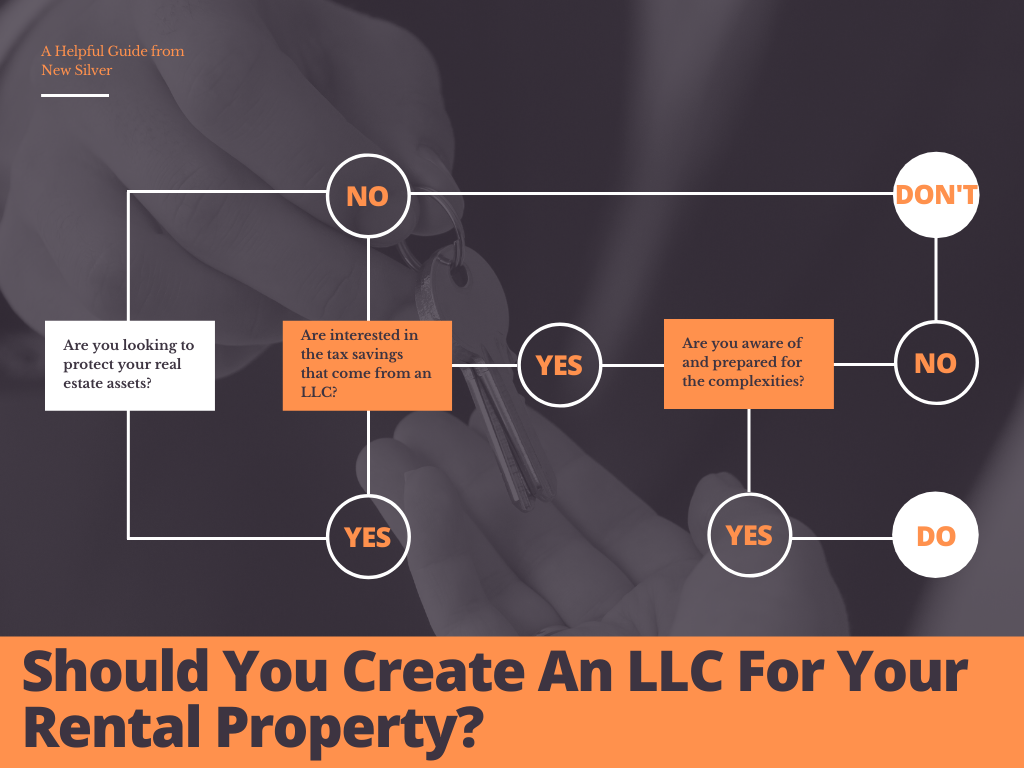

An LLC is a US business structure that combines the limited liability protection of a corporation with the simplicity and pass-through taxation of a sole proprietorship. This is the dream that most people have when. Depending on your specific situation and unique circumstances the following may be considered pros for.

The key disadvantages relate to. In some circumstances owners of an LLC may end up paying more taxes than owners of a corporation. The price of setting up an LLC varies depending on the state and can range from.

The initial fees of creating an LLC for rental property are one of the main drawbacks. Much like starting an LLC for any other company there are financial and legal benefits to running your rental property under an LLC. Disadvantages of Corporate Enterprises.

An LLC is the American form of a private limited company. The advantages and disadvantages to owning rental property in an LLC. A limited liability company can.

While LLCs have many benefits they also come with some drawbacks. Using an LLC to own your property rental business has key advantages when it comes to liability protection insulating your assets and ownership flexibility. There are many advantages to establishing an LLC for your rental properties.

Profits subject to social security and medicare taxes.

Should Rental Property Be In An Llc Or A Trust

Creating Llc For Rental Property Ny Rent Own Sell

Should You Create An Llc For Rental Property Pros And Cons New Silver

What Are The Advantages And Disadvantages Of Renting Toughnickel

What Is An Llc Definition Pros Cons Forbes Advisor

Renting Vs Buying House Pros And Cons Better Mortgage

Can My Llc Buy My House Fibyrei

Forming An Llc For Real Estate Investments Pros Cons Legalzoom

Llc For Rental Property Pros Cons Explained Simplifyllc

Should You Put Rental Properties In An Llc Umbrella Llc For Real Estate Passive Income

A Guide To Buying A House With An Llc Rocket Mortgage

Creating An Llc For Single Family Rental Properties Advantages Disadvantages

Advantages And Disadvantages Of Llcs Rocket Lawyer

Llc For Rental Property What Should Real Estate Investors Do

Llc For Rental Property Pros Cons Explained Simplifyllc

23 Pros And Cons Of Using Llc For A Rental Property Brandongaille Com

Llc For Rental Property All Benefits Drawbacks Alternatives

Forming An Llc And Incorporating A Real Estate Investment Business

Using A Limited Liability Company Llc For Real Estate Investments What S Really At Risk When You Get Sued By Sarah Holmes